Look, we’ve all been there.. when you first look into the forex market and you’re overwhelmed by the pure size and complexity of trading it.

To start trading in the forex market, the first step is to choose a trading platform that suits your needs. A trading platform is a software application that allows you to access the forex market, place trades, and manage your trading account. Here are some key features to look for when selecting a trading platform:

- User Interface: A user-friendly interface is crucial, especially for beginners. The platform should be easy to navigate and provide clear, intuitive access to all necessary functions.

- Charting Tools: Advanced charting tools are essential for analyzing the market and making informed trading decisions. Look for platforms that offer a wide range of technical indicators, drawing tools, and customizable charts.

- Order Execution: The platform should provide fast and reliable order execution to ensure that your trades are executed at the desired price.

- Security: Security features such as two-factor authentication (2FA) and encryption are important to protect your trading account and personal information.

- Customer Support: Responsive customer support can help resolve any issues or questions you may have while using the platform.

the most popular trading platforms are MetaTrader 4 (MT4)/MetaTrader 5 (MT5), and TradingView. Each platform has its own strengths and features, so it’s important to try out a few options and see which one works best for you.

Some of us personally use TradingView for charting and MT4/5 for execution. The reason for this is that TradingView is an amazing charting platform.. Our broker is amazingly fast with executions.. why combine the two and risk latency / connectivity issues? I mean, everyone has more than one screen now days right…!?

Charts

Charts are a fundamental tool for trading forex, as they provide a visual representation of price movements and help in analyzing market trends. There are several types of charts available, each with its own advantages and uses:

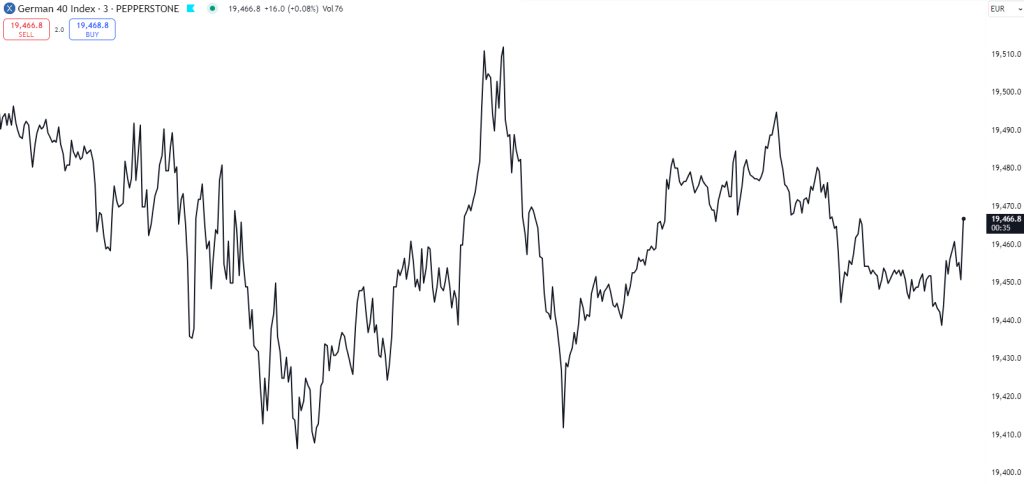

- Line Chart: The line chart is the simplest form of chart, showing a line connecting closing prices over a specified period. It provides a clear view of the overall trend but lacks detailed information.

Line Chart

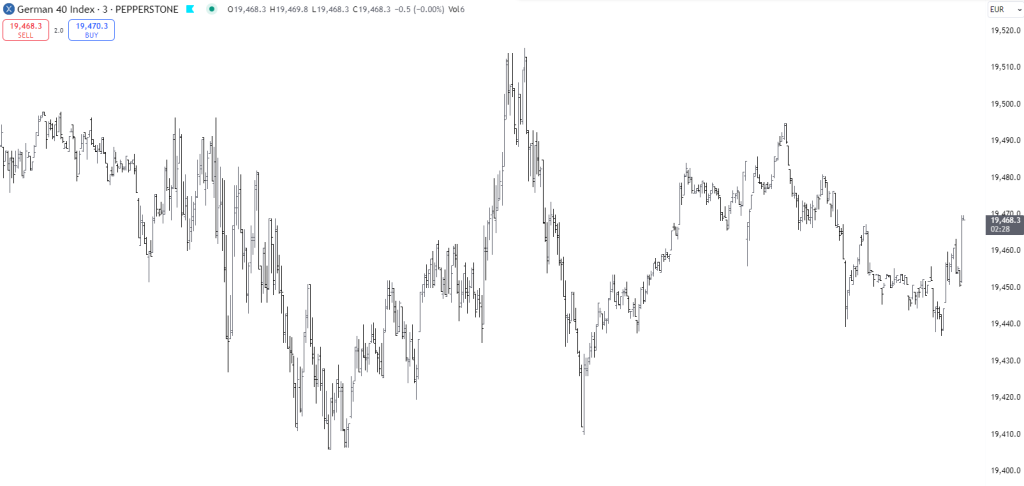

- Bar Chart: The bar chart displays price bars for each time period, showing the open, high, low, and close (OHLC) prices. This type of chart provides more information than a line chart and is useful for identifying price patterns.

Bar Chart

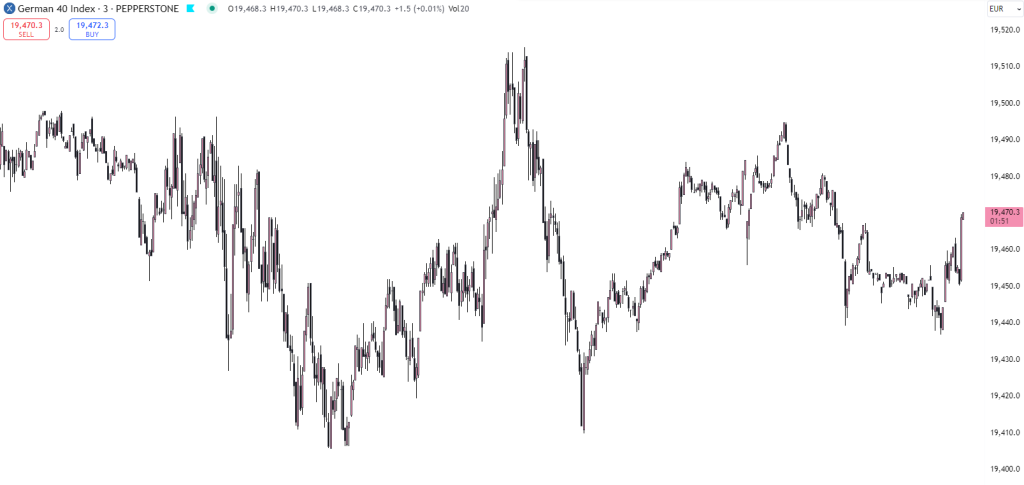

- Candlestick Chart: The candlestick chart is similar to the bar chart but uses candlesticks to represent price movements. Each candlestick shows the open, high, low, and close prices, with the body of the candlestick indicating the range between the open and close. Candlestick charts are popular among traders for their visual appeal and ability to highlight patterns and trends.

Candlestick

There’s honestly no right answer when it comes to chart types. Most traders use the candlesticks, but that’s most likely due to the popularity of them on online forums, and YouTube videos in the last few years. The choice of chart depends on you. Some traders prefer bars, others prefer candlesticks. The best way to work out what works for you is to play around with the settings until you find a ‘layout’ that helps you identify patterns, trends etc. At the end of the day, it needs to “make sense” to you.

Order Types

We’re touching on this as a lot of traders seem to either not know about this, or simply forget about it. Understanding the different types of orders is essential for executing trades effectively. Here are the main types of orders you will encounter in forex trading:

- Market Order: A market order is an order to buy or sell a currency pair at the current market price. This type of order is executed immediately and is used when you want to enter or exit a trade quickly.

- Limit Order: A limit order is an order to buy or sell a currency pair at a specified price or better. It ensures that you enter or exit a trade at the desired price but may not be executed if the market does not reach that price.

- Stop Order: A stop order, also known as a stop-loss order, is an order to buy or sell a currency pair once the price reaches a specified level. It is used to limit potential losses by closing a trade at a predetermined price.

- Stop-Limit Order: A stop-limit order combines elements of both stop and limit orders. It triggers a limit order once the stop price is reached, ensuring that the trade is executed within a specified price range.

- Trailing Stop Order: A trailing stop order is a dynamic stop order that adjusts with the market price. It helps protect profits by moving the stop price in the direction of the trade, allowing for potential gains while limiting losses.

Types of Trading

This is important. What type of forex trader are you!?

Forex trading encompasses various trading styles, each with its own strategies and timeframes. Here are three common types of trading:

Swing Trading (our favourite)

Swing trading is a medium-term trading style that aims to capture price swings within a trend. Swing traders typically hold positions for several days to weeks, taking advantage of short- to medium-term price movements. This trading style requires a good understanding of technical analysis and the ability to identify trend reversals and continuation patterns.

Key Characteristics of Swing Trading:

- Timeframe: Trades last from a few days to several weeks.

- Objective: Capture short- to medium-term price swings.

- Analysis: Relies heavily on technical analysis, trend lines, and chart patterns.

- Risk Management: Uses stop-loss orders to limit potential losses.

Swing trading is suitable for traders who prefer a more relaxed approach compared to day trading, allowing them to analyze the market and make decisions without the pressure of real-time trading.

Breakout Trading (Popular)

Breakout trading involves entering a trade when the price breaks through a significant support or resistance level. Breakouts often lead to substantial price movements, making this strategy popular among traders looking to capitalize on strong market trends.

Key Characteristics of Breakout Trading:

- Timeframe: Can be short-term or long-term, depending on the breakout and market conditions.

- Objective: Profit from significant price movements following a breakout.

- Analysis: Uses support and resistance levels, chart patterns, and volume indicators to identify potential breakouts.

- Risk Management: Places stop-loss orders below support or above resistance levels to protect against false breakouts.

Breakout trading requires patience and the ability to identify high-probability breakout scenarios. Traders must also be prepared for potential false breakouts, where the price reverses after briefly moving beyond a key level.

Scalping (Popular but very difficult to get the hang of)

Scalping is a short-term trading style that involves making numerous trades throughout the day to capture small price movements. Scalpers aim to profit from minor price fluctuations and often hold positions for just a few seconds to minutes.

Key Characteristics of Scalping:

- Timeframe: Trades last from a few seconds to a few minutes.

- Objective: Capture small price movements for quick profits.

- Analysis: Relies on technical analysis, real-time charts, and fast execution.

- Risk Management: Uses tight stop-loss orders and quick exits to minimize losses.

Scalping requires a high level of concentration, quick decision-making, and the ability to execute trades rapidly. This trading style is best suited for experienced traders who can handle the pressure of high-frequency trading and have access to low-latency trading platforms.

Conclusion

Getting started in forex trading involves selecting a suitable trading platform, understanding different types of charts, mastering various order types, and choosing a trading style that aligns with your goals and risk tolerance. Whether you prefer the medium-term approach of swing trading, the strategic entry points of breakout trading, or the fast-paced nature of scalping, each style offers unique opportunities and challenges.

As you embark on your forex trading journey, it’s crucial to continuously educate yourself, practice sound risk management, and develop a disciplined trading plan. By doing so, you can navigate the complexities of the forex market and work towards achieving your trading objectives.