This post might be a little late to the game, but we decided our previous one didn’t touch on enough detail for the forex market this year.

The forex market in 2025 is shaping up to be highly volatile, influenced by a combination of monetary policy shifts, geopolitical risks, trade tariffs, and commodity market fluctuations. We have Trump getting into office and throwing around executive orders left, right and centre, the war in Ukraine trying to come to an end, and many other factors that will undoubtably provide us with volatility.

Investors and traders must stay on-deck with the news and macroeconomic developments this year. As volatility remains elevated across major currency pairs, we believe there will be added volatility from the ongoing implementations of U.S. tariffs, central bank policy shifts, and macroeconomic trends across major currencies.

U.S. Dollar Strength Amid Tariff Uncertainty

One of the biggest themes of 2025 is the strength of the U.S. dollar (USD) – the Trump administration’s renewed tariff policies, particularly targeting China, Canada, and Mexico, have fueled concerns over the disruption of global trade. Some analysts have been anticipating effective tariffs on China rising from 10% to 30%, with potential for an extreme 60% scenario. The U.S. dollar index (DXY) has shown signs of overvaluation, with a premium of around 3% over relative interest rate differentials, suggesting that traders have already priced in the risk of tariffs. If we look at the technicals, we’ve definitely had a bit of a retracement from the strong bullish trend we’ve been dealing with recently.

With a strong U.S. labor market and resilient economic data, the FED remains cautious in easing monetary policy. Although some analysts expect 100 basis points in rate cuts by year-end, the first half of 2025 is likely to see higher-for-longer U.S. rates, further bolstering the greenback.

Could this mean that we’re likely to see the high range of $112-$114 again? Only time will tell..

Euro (EUR) Faces Political and Economic Headwinds

The Euro is under pressure due to economic stagnation in the eurozone and increasing concerns over political risks. Germany’s economic outlook remains uncertain, and the broader Euro Area is exposed to potential U.S. tariffs, particularly in the automotive sector. The European Central Bank (ECB) is expected to maintain a dovish stance, with possible rate cuts by mid-year to stimulate growth.

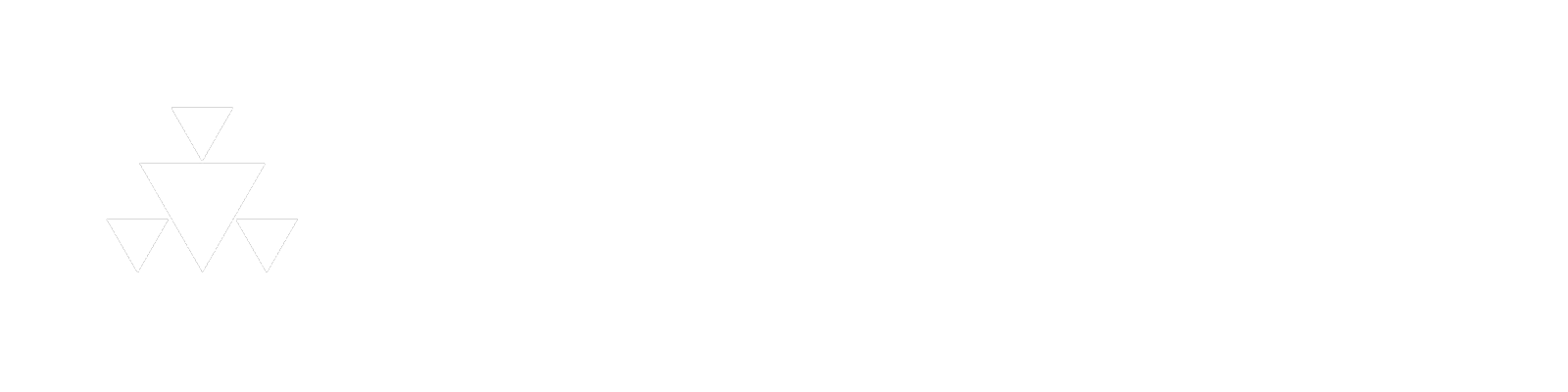

Additionally, interest rate convergence between the EUR and other low-yielding currencies like the Japanese yen (JPY) and Swiss franc (CHF) has led to increased usage of the EUR as a funding currency. As a result, some traders are positioning for further downside in EUR/JPY, with expectations of the pair reaching 149. And, I mean, there is some merit to it you take into account the large head & shoulders pattern forming:

Japanese Yen (JPY): Weighed Down by Policy Divergence

Despite expectations of at least two 25-basis-point rate hikes from the Bank of Japan (BoJ) in 2025, the Yen continues to face headwinds against the USD. The USD/JPY pair is projected to remain above 150 for most of the year, with some relief expected in the second half as U.S. economic growth moderates.

British Pound (GBP): Brexit Aftershocks and Economic Concerns

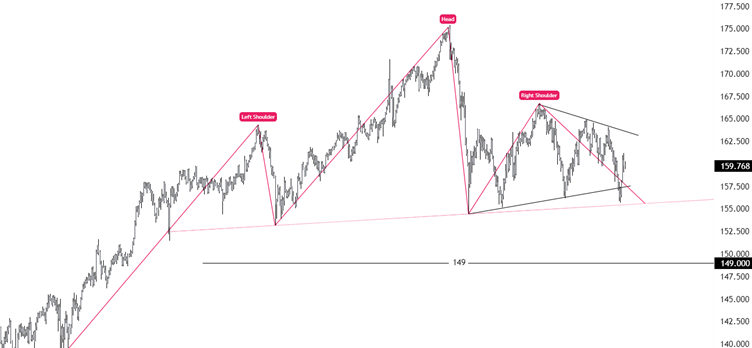

The pound (GBP) remains somewhat vulnerable to trend weakness, with Brexit-related uncertainties still influencing investor sentiment (I know what you’re thinking; it’s still going..). Although the worst of the 2022 turmoil has passed, the UK economy does face a challenging year ahead. Analysts have been typically favoring a short GBP/CAD position, given the potential rebound in Canadian assets after the country’s elections. And there’s definitely some merit in that from a technical perspective:

We’re definitely turning over from the recent bullish trend on GBPCAD – we’ve actually placed this on our watchlist given the current consolidation. Our view is a short position on the break of this range, but we will wait to see how this consolidation unfolds and whether or not the macro’s still support the short position.

Australian Dollar (AUD) and Reserve Bank of Australia (RBA) Policy Shifts

The Aussie Dollar remains under pressure, with the Reserve Bank of Australia (RBA) expected to cut rates by 25 basis points in both February and August 2025. Australia’s economy has shown resilience, but weak inflation data (and exposure to external risks). China’s economic slowdown and trade tensions with the U.S., are going to weigh on the Aussie.

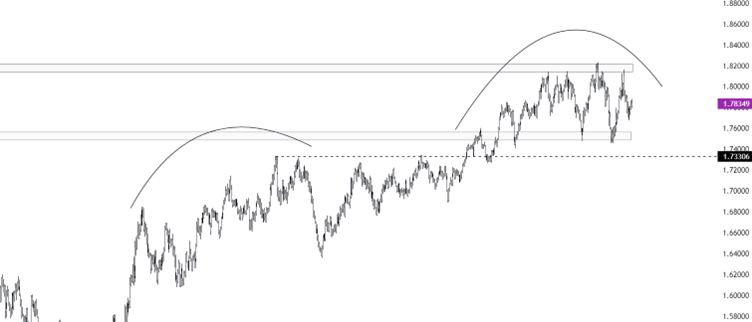

Analysts are suggesting that AUD/USD could test the 0.60 level before recovering in the second half of the year. Could this be the scenario?

Whilst the currency remains sensitive to U.S.-China relations, any improvement in China’s policy stimulus measures could provide support to the AUD.

Outside of Forex: Gold and Precious Metals Outlook

Gold prices were originally forecasted to reach $2,850/oz in 2025.. but have already reach there.. in fact, they’ve reached a high of $2,942.78!

With this bullish trend, we’re actually looking to go short at $3,000 for a couple of reasons:

- It’s a key fundamental/psychological level, and;

- $3,000 for an ounce!? Are you kidding? That’s way over valued!

Despite a stronger USD and high U.S. yields posing short-term disruptions, demand for gold as a safe-haven asset is expected to persist. I mean, this has been the case for decades and it’s not looking like it’ll change any time soon.

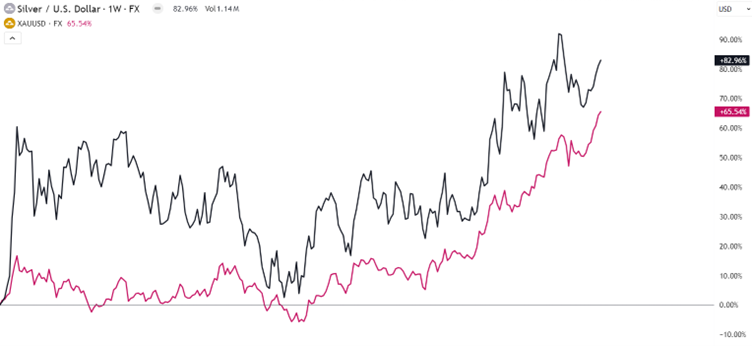

Silver, often considered “poor man’s gold,” is likely to see strong demand due to its industrial applications. After all, it’s closely correlated with gold:

Some analysts have been commentating on the fact that silver prices could rise to $36-$38/oz, supported by a global manufacturing recovery – which is supported on a technical level as shown below:

Final Thoughts & Strategic Considerations

The 2025 forex market presents a landscape of both risks and opportunities. While the USD remains dominant in the near term, potential shifts in monetary policy, trade relations, and commodity prices will influence currency movements throughout the year. Traders should stay attuned to macroeconomic trends and geopolitical developments to navigate the evolving forex environment effectively

- USD Strength in Q1 & Q2: With U.S. real yields remaining high and trade policies favoring the dollar, expect continued strength in the first half of 2025.

- Opportunities in Precious Metals: Given geopolitical risks and inflationary pressures, gold and silver offer strong hedging opportunities.

- Short EUR/JPY and GBP/CAD: Political uncertainty in Europe and a potential Canadian recovery make these attractive trades.

- Caution on AUD: The Australian dollar remains vulnerable to China’s economic performance and RBA rate cuts.

- China’s Policy Response: Watch for signs of further stimulus and potential trade agreements that could impact CNY and broader risk sentiment.

If you’d like a more customed analysis and report – please register your interest here.